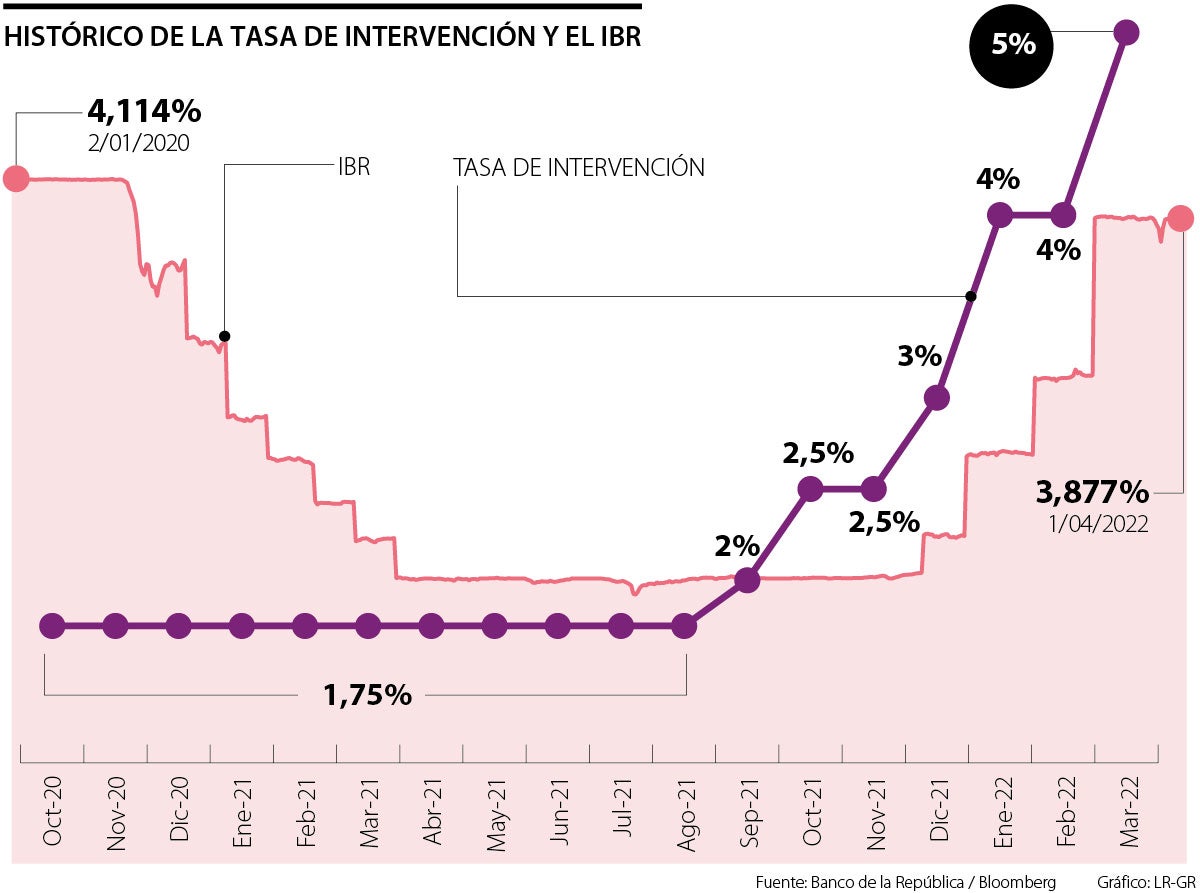

This Thursday, the Banco de la República Board increased its response rate by 100 basis points. Thus, the policy rate reached 5%, transmitter On the demand side, it expects to reduce the amount of money in the economy by affecting inflation expectations.

But what are the consequences of raising the interest rate? One is that credit becomes more expensive, so people are likely to reduce their consumption and are likely to be less willing to request sources of credit such as buying housing, cars, among other products.

The issuer’s decision will lead to increases in the rates that commercial banks charge for loans, which will affect the way households spend. According to experts, at the rates applied to consumers, transmission will take between six and eight months, making home and consumer loans more expensive.

On the other hand, financial institutions have an impact immediately after the announcement through the Current Bank Rate (IBR), which reflects the price at which banks are willing to raise or raise funds in the market. The cost of interbank and simultaneous transactions is expected to be close to 5%.

“Monetary policy in general and its impact on credit are lagged, with transmission on residential and consumer lines being delayed for up to six months. “With credit cards, it’s not so obvious because they’re often related to the usury rate,” he said. corficolombana.

If a reverse analysis is made, it is expected that the rate of catching funds from consumers will increase with the increase in the interest rates of the issuers. “If, due to an increase in the intervention interest rate, it becomes more expensive for a financial institution to borrow resources from either Banco de la República or the rest of the financial system, that business will have an incentive to attract more resources. From the public for encouraging us to save by raising the interest rates at which our deposits are paid.

But the transmission of monetary policy is volatile as it depends on the moment of the economic cycle, “We’re expanding right now and in fact the Federal Reserve says the economy will grow by 4.7% this year. It could certainly be faster than normal, it could be in six to eight months,” explained chief economist at Scotiabank Colpatria. Sergio Olarte.

However, this does not mean that interest rates have not risen, as the Issuer’s hike cycle started in September 2021 and has already been noticed in the loan market.

Interest rate fell below expectations

Since October 2021, the monetary policy rate has doubled, from 2.5% back then to 5% in March this year. So far in 2022 rates have increased by 200 points; however, the magnitude of the increase in the last meeting (100 points) fell short of the analysts’ expectations, which expected 150 points.

Banco de la República entered a period of monetary normalization to curb inflation, which reached 8.01% in February and is expected to continue rising before even falling.

Source: Lare Publica