Table of Content

- Markets Are Pricing In A Stormy 2020 Finale

- Institutional Structure And Coverage Responses

- Family Debt To Income

- Early Nineties Recession In America

- Elevating Interest Rates

- 1838 Recession

- Why Does The Economic System Fall To Items After A Financial Crisis?

- With Congress Stalled On Stimulus, Uc Labor Experts Warn: Bold Federal Action Required To Maintain The Us Out Of A Melancholy

- Recession Of 1937

One week later, on Oct.6, the federal government passed emergency legal guidelines enabling the FME to take over banks. Through this legislation, Icelandic officers formally nationalized Landsbanki and Glitnir. The Icelandic Finance Ministry is a department within the national government.

One channel by way of which the crisis of 2008 unfold was the holding of US financial belongings by governments, financial institutions, and banks in different nations. Take, for example, mortgages that were marketed and issued in the United States.

Markets Are Pricing In A Stormy 2020 Finale

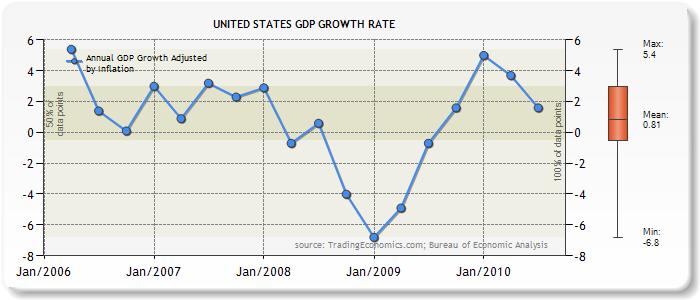

Of course, reducing the goal interest rate wasn’t the one factor the Fed and the U.S. government did to combat the Great Recession and decrease its results on the financial system. By the top of 2008, the Fed had reduced the goal rate of interest to zero p.c for the first time in historical past in hopes of once once more encouraging borrowing and, by extension, capital funding.

Specifically, financial establishments around the world will proceed to face a marked rise in non-performing loans for a while. The COVID-19 crisis is also regressive, disproportionately hitting low-income households and smaller companies that have fewer assets to buffer them against insolvency. With fears that comparable collapses could be sustained by other major financial corporations and banks, President Bush permitted the Troubled Asset Relief Program in October 2008. TARP basically provided the U.S. government with $seven hundred billion in funds to purchase the assets of struggling companies in order to hold them in business. The deals would enable the government to promote these assets at a later date, hopefully at a profit. However, even with these interventions, the country’s economic troubles had been far from over.

Institutional Construction And Coverage Responses

President Trump on July 30 advised the presidential election must be delayed because the economic system, along with voting strategies and overall safety throughout COVID-19, continued being debated. A second stimulus bill was nonetheless being worked on at the end of July as components of the prior stimulus bill—including an evictions moratorium and enhanced unemployment benefits—expired. Strict monetary policies geared toward reducing inflation produced the worst recession since the Great Depression. Manufacturing, auto, and building industries suffered sharp increases in unemployment, which rose practically 4% from .

This indicates that despite bettering budget deficits, GDP progress was not sufficient to support a decline within the debt-to-GDP ratio for these nations throughout this period. Eurostat reported that the debt to GDP ratio for the 17 Euro area international locations together was 70.1% in 2008, seventy nine.9% in 2009, 85.three% in 2010, and 87.2% in 2011.

Family Debt To Earnings

Over the course of the crisis, more than 13,000 CDO investments that were rated AAA—the best potential score—defaulted. This crisis originated in London and quickly spread to the rest of Europe. In the mid-1760s the British Empire had accrued an unlimited quantity of wealth by way of its colonial possessions and trade. This created an aura of overoptimism and a period of rapid credit enlargement by many British banks. The hype got here to an abrupt end on June eight, 1772, when Alexander Fordyce—one of many partners of the British banking home Neal, James, Fordyce, and Down—fled to France to flee his debt repayments.

Just as easy mortgages fueled financial growth in the 2000s, low cost corporate debt has accomplished so up to now decade, and lots of corporations have binged on it. The federal authorities stepped in to rescue the other big banks and forestall a panic.

Early Nineties Recession In The United States

The economic fallout from this pandemic cannot be resolved absolutely till the pandemic itself comes under management. History means that efficiently ending the acute stage will demand huge, bold, and timely financial coverage responses. “If you look at the Depression there actually was this kind of delegitimization of free-market capitalism, so that you saw in the U.S. and around the globe the growth of regulation as a result of there was a sense that free markets on their very own didn’t deliver stable progress.

So the more mortgages originated, the more fees, and the extra earnings for the originators, no matter what the creditworthiness of the debtors may be . Investment banks have an analogous perverse incentive in their function as brokers or middlemen within the securitization course of. Investment banks primarily buy mortgages from the originators and promote them to the final traders, and make most of their money from “processing charges” (or “dealer charges”). So once more, the more mortgage-based mostly securities bought, the extra fees and income for funding banks, whether or not the debtors could make their payments down the road. An necessary further consequence of the higher income and the continued weak spot of enterprise funding was that financial capitalists had a lot of money to lend, but non-financial corporations didn’t have much must borrow. Meanwhile, staff were strapped with stagnant wages and were all too desperate to borrow cash to purchase a home or a brand new automobile, and typically even basic necessities. So financial companies increasingly targeted on staff as their borrower-prospects over the past decade or so, especially for residence mortgages.

Raising Rates Of Interest

Government bailouts may have saved the economic system, however to many individuals they didn’t feel honest. This paper sets the context for the Asian Development Outlook 2009 with an emphasis on rebalancing growth in developing Asia and, by implication, the world economy. What I’m about to describe is necessarily speculative, however it’s rooted in the experience of the previous crash and in what we learn about present bank holdings. The objective of laying out this worst-case state of affairs isn’t to say that it will necessarily come to move. That alone ought to scare us all—and inform the way in which we take into consideration the next yr and past.

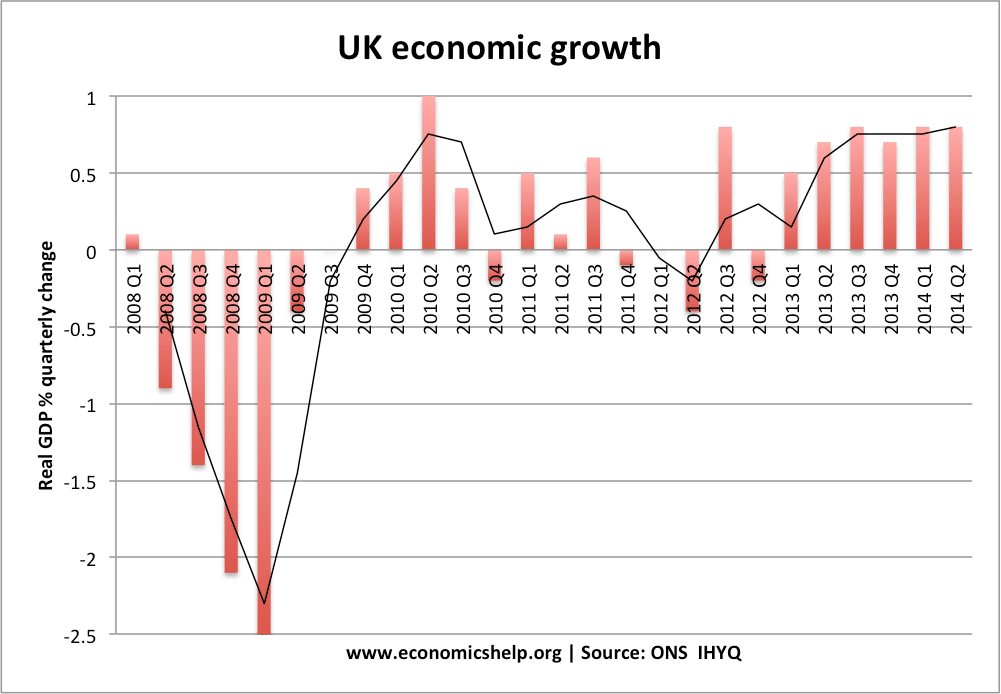

The financial crisis had an influence on China largely through trade linkages. As the level of economic exercise in these economies slowed, the demand for goods and providers produced in China decreased as well. As shown within the circular move of revenue (Figure 15.2 “The Foreign Sector within the Circular Flow”), the discount in exports by China led to reduced output from Chinese companies, decreased income for Chinese households, and lower spending through the multiplier process. The United Kingdom was one of many first nations to face serious implications of the financial crisis when, in September 2007, there was a run on a lending establishment known as Northern Rock.

1838 Recession

By that definition, within the United States, the Great Recession started in December 2007. From that time, till the occasion’s finish, GDP declined by four.three p.c, and the unemployment rate approached 10 p.c. The need to reply forcefully to the present economic shock, which is not equivalent to the precipitating shocks in 1929 and 2008, is nonetheless vital.

Adding to those non-public-sector developments, downgrades of sovereign credit score rankings reached a document high in 2020 . Although superior economies haven’t been spared, the results for banks are extra acute in emerging and creating economies where governments’ credit rankings are at or near junk grade. In more extreme instances of sovereign default or restructuring – and such crises areon the rise, too – banks will also take losses on their holdings of government securities.

Why Does The Economy Fall To Items After A Financial Crisis?

Even although China owned many US assets, most were not directly linked to mortgage-backed securities. Instead, the Chinese had been holding about $900 billion of US Treasury securities.

And while EGRRCPA left the basic framework of Dodd-Frank in place, President Trump has long vowed to “do a quantity on” Dodd-Frank.If Republicans retain management of Congress this November, they might nicely pursue the CHOICE Act or some comparable roll-back laws. At the identical time, a minimum of with respect to the present DOJ, its enforcement priorities embody violent crime, immigration, and the opioid crisis, and it could be less wanting to pursue financial sector executives.

George-65Tucker, a distinguished contributor at SocialBites.ca, is celebrated for his exceptional talent in article writing. With a discerning eye for detail and a flair for storytelling, George crafts engaging and informative content that resonates with readers. His contributions reflect a deep-seated passion for insightful journalism and a commitment to delivering high-quality articles.