Table of Content

- Chapter 15 The Worldwide Financial Crisis

- Icelandic Banking And Gdp Growth, 2000

- Five Ways The European Debt Crisis May Have An Effect On The U S.

- 2 From Financial Crisis To Recession

- 1 The Financial Crisis In The United States

- Views On The Financial Crisis

- Monetary Coverage

- Life Evaluation In The Crisis

- 1891 Recession

The Financial Stability Board (“FSB”) was established in 2009 by the G-20 to coordinate the work of national authorities and international normal-setting bodies on the post-crisis reform agenda. Despite institutional attempts to mitigate the results of the subprime mortgage crisis, the tide of defaults, foreclosures, and losses continued to swell. In March 2008, following a “run on the bank” by Bear Stearns customers, counterparties and lenders, J.P.

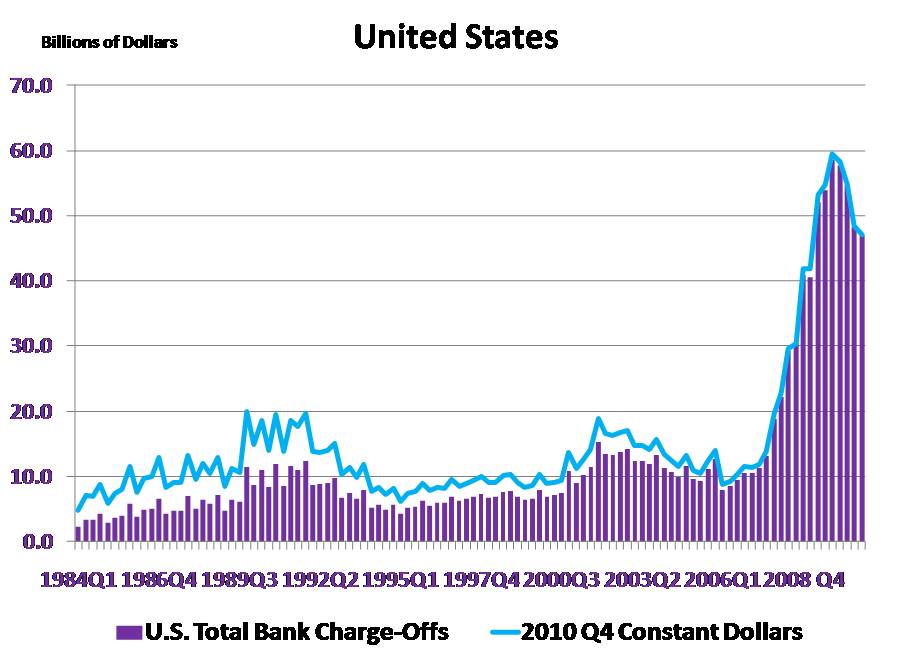

The early losses from CLOs will not on their own erase the capital reserves required by Dodd-Frank. And a number of the most irresponsible gambles from the last crisis—the speculative derivatives and credit score-default swaps you could remember studying about in 2008—are less widespread today, consultants advised me. But the losses from CLOs, combined with losses from different troubled belongings like these business-mortgage-backed securities, will result in serious deficiencies in capital. Meanwhile, the identical economic forces buffeting CLOs will hit other parts of the banks’ steadiness sheets exhausting; because the recession drags on, their traditional sources of income may even dry up. For some, the erosion of capital could method the levels Lehman Brothers and Citigroup suffered in 2008.

Chapter 15 The Worldwide Financial Crisis

This is the multiplier course of; it exhibits up as the term 1/(1 − marginal propensity to spend), which multiplies autonomous spending in the expression for real GDP. The framework tells us that a reduction in autonomous spending results in a decrease in actual GDP. Although we’ve written the equation in nominal terms, we could equally work with the actual version of the same equation. In that case, the value of the service flow and the future price of the home must be adjusted for inflation, so we’d use the real interest factor somewhat than the nominal interest factor. The second factor is the worth you’d anticipate to obtain had been you to decide on to sell the house next yr. If you count on housing prices to be excessive in the future, then the home is price extra at present. This is true even when you don’t really plan to sell the house subsequent 12 months.

But, along with these tendencies, a quieter crisis now gaining momentum might jeopardize financial restoration prospects for years to come. With no marketplace for the mortgages it owned, and subsequently no way to promote them to recoup their preliminary funding, New Century Financial collapsed. Just a number of months later, in August 2007, American Home Mortgage Investment Corp. became the second major mortgage lender to crack underneath the stress of the subprime crisis and the declining housing market when it entered Chapter eleven chapter. There are important differences between the financial fallout from the coronavirus crisis and these earlier crises.

Icelandic Banking And Gdp Growth, 2000

Apart from proposals on international financial regulation, they pledged to take measures to assist their financial system and to coordinate them, and refused any resort to protectionism. Most political responses to the economic and financial crisis has been taken, as seen above, by particular person nations. Some coordination took place on the European stage, but the necessity to cooperate at the global level has led leaders to activate the G-20 main economies entity. A first summit devoted to the crisis happened, on the Heads of state level in November 2008 (2008 G-20 Washington summit). In developing and rising economies, responses to the global crisis mainly consisted in low-charges monetary policy coupled with the depreciation of the currency towards the dollar. There had been also stimulus plans in some Asian countries, in the Middle East and in Argentina.

The FOMC needed to weigh this concern in opposition to the view that, with a sluggish financial recovery and no indicators of inflation, expansionary financial coverage was still warranted. When the FOMC took the unusual decision to commit to low interest rates for two years, three members of the committee dissented from the choice.

Five Methods The Eu Debt Crisis May Affect The U S.

Historians have claimed that the economic repercussions of this crisis have been one of the major contributing elements to the Boston Tea Party protests and the American Revolution. A financial crisis is a state of affairs where the worth of assets drop quickly and is commonly triggered by a panic or a run on banks. The U.S. Treasury nationalized mortgage guarantors Fannie Mae and Freddie Macto maintain the housing market afloat. Frightened corporations withdrew a report $169 billion from their cash market accounts. High-interest rates to curb inflation created the worst recession since the Great Depression. Fed Chairman Paul Volcker usedcontractionary monetary policyto end the crisis. The G-20 international locations met in a summit held on November 2008 in Washington to handle the financial crisis.

In August 2007, BNP Paribas suspended the calculation of web asset values in three investment funds that had bought mortgage-associated belongings and suspended the power of investors to redeem investments in these funds. In November 2007, Citigroup introduced it would incur $8 to $eleven billion in previously surprising fourth-quarter losses related to its investments in subprime-related exposures. We count on 10-12 months Treasury yields to fall by half across the subsequent recession, from a possible peak of three.5%. Poorly conceived and uncoordinated rules have broken our economic system, inhibiting growth and jobs.

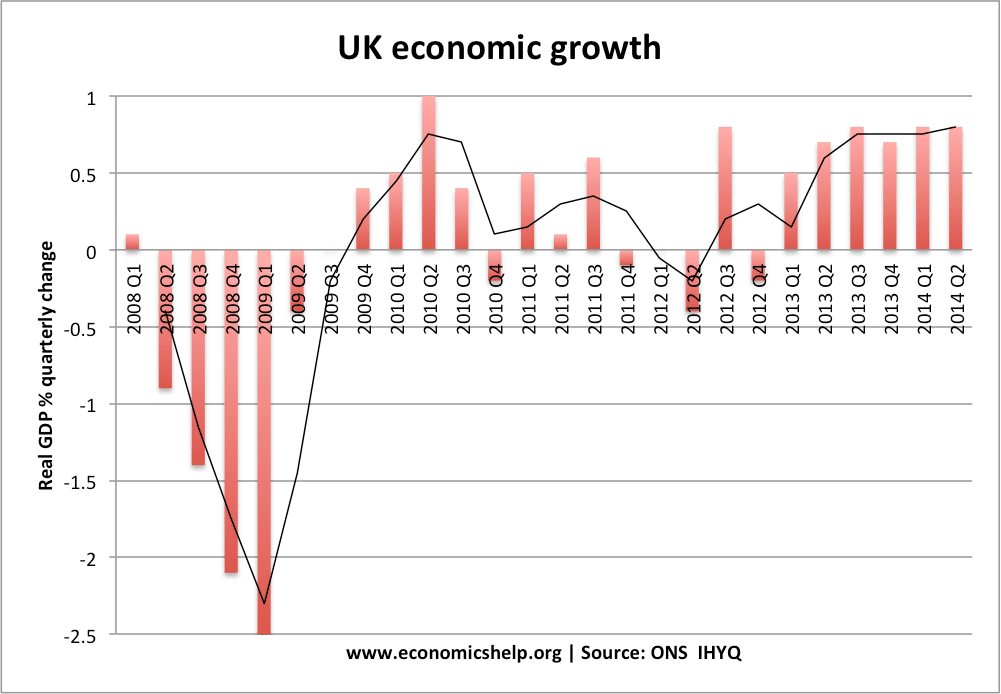

2 From Financial Crisis To Recession

To a substantial degree, these traders have changed traditional financial establishments as both important lenders to, and key collectors of, chapter eleven debtors, and have proved to be subtle and aggressive voices in the restructuring process. Private funds have crammed other spaces vacated by funding banks, similar to mezzanine lending and shopping for troubled mortgages held by federal companies and banks. Certain major private fund managers have gone public.Ten years after the financial crisis, personal fund managers are commonly concerned in the largest company transactions and supply essentially the most prized jobs in the financial sector. We focus on under a number of the key impacts and developments we have noticed within the decade following the financial crisis, including the impression on global financial institutions, the rise of personal equity and hedge funds, and the emergence of shareholder activism. We also survey how the financial crisis has reshaped regulatory and market practices regarding derivatives, securitization, M&A, bankruptcy, and actual property. The financial crisis ravaged the U.S. and world economies and required extraordinary government interventions to prevent a major worldwide despair. It spurred a number of legislative, regulatory, enforcement, litigation, and political responses, many of which are still unfolding.

Dodd-Frank capital and different requirements and the Basel III requirements have forced banks to construct capital and maintain minimal leverage ratios. FHFA finally collected more than $20 billion in settlements, together with $5.8 billion from Bank of America, $5.5 billion from RBS, $4 billion from J.P. Morgan, $1.9 billion from Deutsche Bank, $1.3 billion from Morgan Stanley, $1.2 billion from Goldman Sachs, and $250 million from Citigroup.After a bench trial towards the final two non-settling banks, FHFA was awarded more than $806 million. That legislation limits the application of assorted provisions of Dodd-Frank with regard to small and mid-sized banks and raises asset thresholds above which larger banks are topic to elevated prudential standards. Unlike different legislative proposals such as the Financial CHOICE Act, the EGRRCPA preserved the essential construction of the Dodd-Frank regime whereas making numerous targeted adjustments. For the remainder of 2008, headlines chronicled financial institution failures and bailouts, together with J.P.

1 The Financial Crisis In America

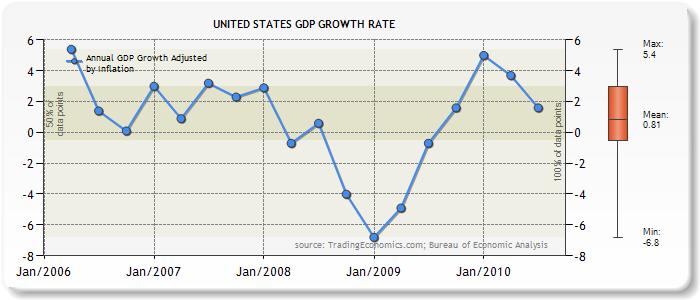

In summer 2007, Countrywide Financial drew down an $eleven billion line of credit after which secured a further $12 billion bailout in September. From late 2007 through September 2008, before the official October 3 bailout, there was a collection of smaller bank rescues that occurred which totaled nearly $800 billion. Bloomberg maintains a “dashboard” of a number of labor-market variables that illustrates the state of restoration of the labor market. On December 1, 2008, the National Bureau of Economic Research declared that the United States entered a recession in December 2007, citing employment and production figures in addition to the third quarter decline in GDP. On January four, 2009, Nobel Memorial Prize–successful economist Paul Krugman wrote, “This looks an terrible lot like the beginning of a second Great Depression.” Those of us who have seemed to the self-interest of lending institutions to guard shareholders’ equity, myself included, are in a state of shocked disbelief.

Beyond that, however, the two successors should govern in a way that’s seen to be just. That means, for instance, demonstrating that those that break the regulation might be punished, even if they’re wealthy and powerful. A leader looking for to assuage these types of concerns, for example, might seek to emphasize white-collar crime, which continues to be too often ignored by prosecutors, and for which the overall number of prosecutions within the U.S. is at a 20-yr low. Whatever their strategy, future leaders must be guided by the concept that has at all times underpinned democratic societies — justice is about much more than financial effectivity.

Views On The Financial Crisis

The big banks settle for smaller returns and the security of the highest layer. Many believe that the Great Depression was triggered by the Wall Street crash of 1929 and later exacerbated by the poor policy choices of the U.S. government. The Depression lasted virtually 10 years and resulted in large loss of income, report unemployment charges, and output loss, particularly in industrialized nations. In the United States the unemployment fee hit almost 25 % on the peak of the crisis in 1933. However, from 2004 via 2006, the Federal Reserve steadily elevated interest rates in an attempt to take care of stable rates of inflation within the economic system. As market rates of interest rose in response, the flow of latest credit via conventional banking channels into real property moderated. Perhaps extra significantly, the charges on current adjustable mortgages and even more exotic loans started to reset at much greater rates than many borrowers expected or were led to anticipate.

In 2003, previous to the numerous growth of subprime lending of , the unemployment fee was close to 6%. The wider measure of unemployment (“U-6”) which includes those employed part-time for economic causes or marginally hooked up to the labor drive rose from eight.4% pre-crisis to a peak of 17.1% in October 2009. When the mortgage industry collapsed, it shocked the U.S. and world economic system.

Monetary Policy

(Dodd-Frank restricted the Fed’s capability to target specific firms, and precluded loans to failing or insolvent establishments.) Government officials will hold frantic conferences, however to no avail. So whereas the banks limit their CLO investments largely to AAA‑rated layers, what they really own is exposure to tens of billions of dollars of high-risk debt.

These mandates had been along with the significant initiatives voluntarily undertaken by regulators in response to the financial crisis. Title X created a brand new agency approved, amongst different things, to concern consumer protection regulations governing providers of economic services to customers, including banks and non-financial institution entities. Dodd-Frank prioritized rulemaking aimed at issues related to the financial crisis, including points regarding mortgage “capacity to pay” necessities, restrictions on compensation for mortgage loan officers, and mortgage servicing requirements. In addition, part one hundred sixty five of Dodd-Frank required important financial establishments, including banks and non-banks, to submit periodic resolution plans or “residing wills” detailing how they would liquidate their property in a “rapid and orderly way” in the event of a bankruptcy. These plans are then topic to review by regulators; lately, the FDIC and the Fed have more and more rejected financial establishments’ dwelling wills, or approved them on the condition that changes be made.

George-65Tucker, a distinguished contributor at SocialBites.ca, is celebrated for his exceptional talent in article writing. With a discerning eye for detail and a flair for storytelling, George crafts engaging and informative content that resonates with readers. His contributions reflect a deep-seated passion for insightful journalism and a commitment to delivering high-quality articles.