Scenario 1 – bet will be placed

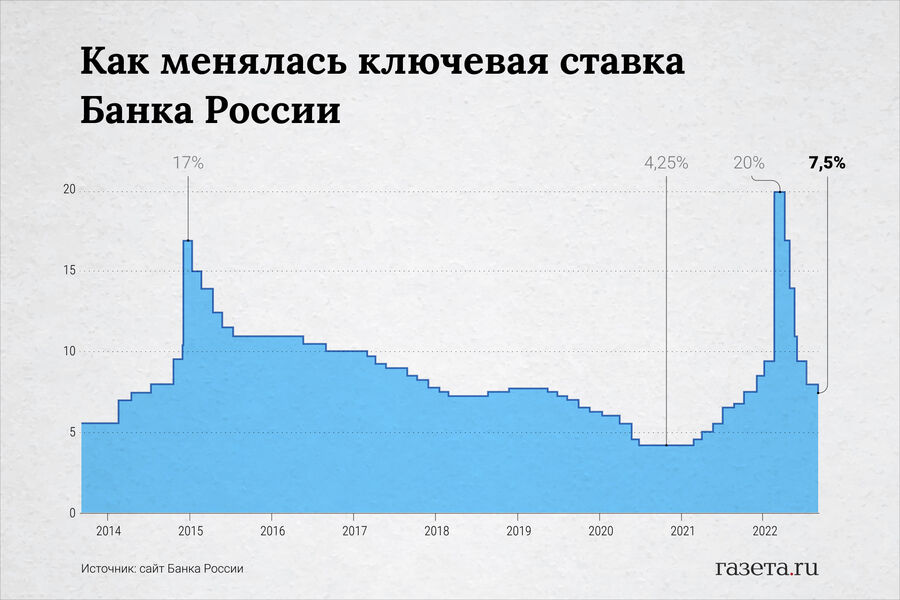

On October 28, 2022, the Central Bank Board of Directors meeting will be held and the key rate level will be decided. Now 7.5% per year.

The National Rating Agency (NRA) believes it will likely be kept at this level. This assumes the analysts base scenario. As explained in the NRA, deflation in Russia has actually stopped and prices have started to rise moderately.

“Since the beginning of October 2022, it has increased by 0.08% – 10.66% since the beginning of the year. The share of goods and services with a current growth rate of over 4% is increasing steadily. At the same time, the share of goods and services whose prices are falling is falling,” he said.

The agency is confident that this trend will continue. The ruble stopped strengthening as fiscal policy was invigorating. There is also shortage of certain goods in connection with the sanctions.

“Inflation in Russia is also slightly affected by price increases in advanced economies. We assume that by the end of December, annual inflation in the Russian Federation will be close to the middle of the 11-13 percent range.

There are other factors that support keeping the rate at 7.5%: The population’s inflationary expectations are rising, businesses’ price expectations are rising. The NRA is confident that under these circumstances it is unlikely that the Federal Reserve will lower its key interest rate.

GV Plekhanova Tatyana Skryl, Associate Professor at the Department of Economic Theory of the Russian University of Economics, is confident that this is the first scenario most likely to be implemented.

“Now price dynamics cause inflationary expectations to rise. By the end of the year, inflation will approach the upper limit estimated by the Central Bank at 13%. In addition, inflationary risks increase on the backdrop of an unstable situation and an increase in budget expenditures. Therefore, the regulator is likely to keep the key rate at the same level,” Skryl said.

BCS World Investments expert Mikhail Zeltser believes the Central Bank will maintain the key interest rate of 7.5% until the end of 2022. In addition to the above, the financier named a number of other factors in favor of this option.

“Mobilization, the possibility of further weakening of the ruble, the slowdown in exports and the reinstatement of imports at the same time cause the Central Bank to pause the soft exchange rate. The withdrawal of citizens to cash led to the outflow of up to one trillion rubles from the banking system last month, ”the expert explained.

Scenario 2 – rate will be increased

The NRA also considers a pessimistic scenario for the development of the key-rate situation. It assumes an annual increase of 0.25 points to reach 7.75%.

“At the end of October, there was a significant increase in the yield on government bonds (OFZ) compared to September 2022. This reflects the increase in risks in the economy. Reasons include ongoing partial mobilization, martial law and high alert regime in some parts of the country, and expectations for the introduction of mobilization measures in the economy. If OFZ returns do not normalize in the near future, a key rate hike is inevitable. Otherwise, the NRA said, coupons for future bonds would be lower than those already placed, which would “push up” the yield.

Agency representatives, however, consider it unlikely that the key rate will be increased at the October 28 meeting.

“This NRA scenario seems less likely. The growth of risks to the economy has already strengthened the population’s austerity mood and lowered consumer demand. The NRA noted that an increase in the rate at this time could adversely affect the prospects for a recovery in gross domestic product.

Anton Pavlov, vice president of Absolut Bank, also agrees with this conclusion.

“An increase in key rate is unlikely. Consumer and credit activities are at a very low level. Implementation of this scenario will lead to an increase in loan interest rates. Against the backdrop of the declining demand of the population, this is a negative factor. On deposits, banks are now raising rates to stimulate saving activity. A 0.25 point growth in the key ratio will not have a significant impact on the profitability of the deposit.”

Alina Dzhus/socialbites.ca

Scenario 3 – rate will be maintained at first, then gradually increased

The agency’s third scenario implies that on October 28, the regulator will keep the key rate at 7.5% per annum, and then move on to an increase cycle by the end of the year and next year.

“The NRA sees a scenario where the Bank of Russia could raise the key rate at the next meetings at the end of 2022 and the beginning of 2023.

It assumes that inflationary pressure is getting stronger. This, with a simultaneous increase in OFZ yields, could cause inflation to go beyond the Central Bank’s forecast horizon. In this case, the regulator may increase the rate by 0.5–1 pp. By March 2023,” the NRA said.

In this scenario, the key rate could reach 8-9% per annum by March 2023.

According to NRA estimates, mortgage rates (excluding preferential programs) will be 7.5-9% over the next three months. In the vehicle loan segment, the rates for new cars will vary between 9% and 14%. And from 11 to 15.5% – for used ones. For consumer loans (depending on the type), the rates will be 9-9.25%. Average deposit interest rates will be around 6-7%. And in some cases – to increase to 8-8.5%.

According to Pavlov, the third scenario is unlikely to be implemented.

“According to the Central Bank’s forecasts, inflation should return to 4% by the end of 2023. “The key interest rate hike does not coincide with these plans,” he said.

The expert believes that a key increase in 2023 is possible only if pro-inflationary risks materialize, which can be triggered by both the geopolitical situation and global trends and an increase in the money supply.

Source: Gazeta

Ben Stock is a business analyst and writer for “Social Bites”. He offers insightful articles on the latest business news and developments, providing readers with a comprehensive understanding of the business world.