The service is free – it is included in the functionality of the SberBank Online mobile phone app. It’s very easy to use – provided you have a Sberbank card (and there are still those of us who don’t or don’t have one?!).

Register, go to the “Pensions” section. To get a certificate of the amount of the pension for today, you need to click on the button and give Sberbank the right to access the information of the state services and consent to the processing of personal data.

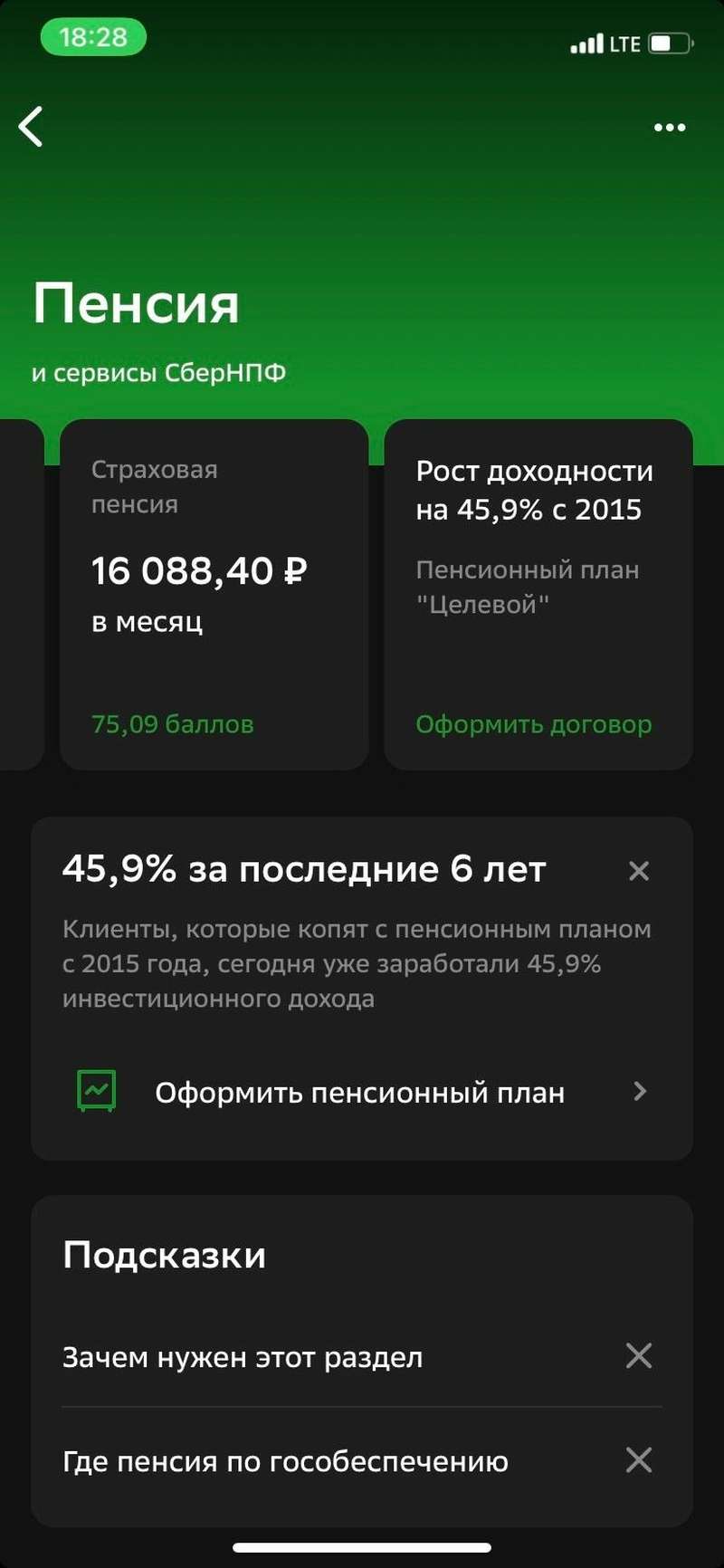

The system takes a few minutes to prepare the certificate. As a result, the application will show how much money you currently have in your funded pension and what your monthly insurance pension will be. There you will find all information about your current pension points and seniority.

We tested the pension service and talk about the results. Of course we couldn’t resist broaching the car topic and asked the question: how can we not lower the standard of living when we retire and also afford to maintain a car.

Tatyana K., 23 years old, secretary

Tanya jokingly took the task of testing the pension service – what a pension, the institute had just ended …. Her monthly expenses are about 80,000 rubles. 40,000 goes to housing, 20,000 to a car (don’t drive daily, but pay off a loan), 5,000 to fitness (can save money), the remaining 15,000 are small, unmanageable expenses. Food, entertainment and so on – on a young man. Tatyana is sure that by retiring (in fact much earlier) she will acquire her own housing and a non-credit car.

The attachment shows that her monthly insurance pension could be 8300 rubles. The work experience is still small. Of course he will grow up. Nevertheless, the service offers to join a financial instrument – an individual retirement plan (IPP). According to preliminary calculations, with the first tranche of the IPP of 5,000 rubles and the same monthly payments, Tatyana will save almost 7 million for retirement and receive 57,150 rubles per month. Enough for gas and fitness. And there will still be.

Ivan B., 31, economist

I do not have a family of my own yet, monthly expenses vary in a wide range, an average of 60,000 rubles comes out. About 20 thousand go to the car, which is used daily. Gas stations “eat” most of this amount. In second place are car washes (Ivan does not tolerate dirt on the car and in the car). The third is maintenance. And a “thin layer” year-round “lubricated” transportation tax and insurance.

Let’s take a look at the application. According to the calculations of the service, the insurance pension he will receive each month will be 16,088 rubles. It would be nice to add another 25,000 or so, so as not to give up the usual stuff. Let’s count. If now, at the age of 31, he draws up an individual pension plan, he will make an initial contribution of 2000 rubles. and every month he will save 3,000, then at age 60 he will save for a monthly increase of 27,100. And importantly, he will be able to receive this raise five years ahead of state pensions. Enough for life and for your favorite car.

Andrey S., age 45, deputy head of the logistics department

Andrei is a family man and has lost the habit of separating his salary from the family budget. However, it is he who monitors and finances the maintenance of the car, and it costs him a little less than Ivan, about 15,000 rubles per month. He also drives every day, but quieter, saves fuel, washes the car less often, insures cheaper, no longer provides comprehensive insurance… And the car is domestically produced.

The proposal to test the pension service was accepted with interest. An extract from the PFR promised him a record pension among our respondents – 23,000 rubles. Andrei explained this by the fact that he had more than 20 years of work experience, and the salary was always “white” and not small.

But of course he also wants to increase his cash receipts on a well-deserved rest. As a deposit, I am willing to give 50,000 rubles and deduct 10,000 rubles monthly. So, at the age of 60, he will be able to save 3,238,900 rubles (of which 1,840,000 are premiums and 1,398,900 investment income). According to preliminary calculations, this will give a monthly payment of 26,950 rubles.

Since Andrey’s wife has been working with Andrey since she was 18, and her pension (also declared by the pension service) is not inferior to the pension promised to her husband, and she is already saving part of her current income for her retirement (women are often more practical), Andrey is sure they will suffice. They retire at about the same time. It even stays put for your favorite (and not cheap) road trips. Several ideas for long routes (from edge to edge of the country) already exist.

***

Of course we only look to the future. But with this service, you can understand what monthly budget (compared to the current one) you can focus on, plan your spending and increase your savings – that is, make the future more predictable. It costs much.

And another simple conclusion: the sooner you start planning for your retirement and saving, the higher your income when the salary stops.

Many will agree that with retirement I would like to maintain the usual standard of living. Someone is counting on payments from the state, but few people know what amounts they are talking about. Although with current technologies you can quickly find out, for example the Pension Showcase service in the SberBank Online mobile application.